John Teets is remembered as a visionary executive who built his net worth—estimated between $50 million and $100 million—not by luck but through bold, strategic business decisions. His career highlights include orchestrating the $350 million sale of Greyhound’s bus operations, transforming the Greyhound Corporation into the successful Dial Corporation, and guiding Dial’s stock to soar 400% over five years. This article explores how Teets’ strategic moves reshaped industries and created lasting wealth, offering valuable insights into his journey, leadership, and legacy.

Profile Summary John Teets Net Worth

| Personal Details | Information |

|---|---|

| Full Name | John W. Teets |

| Date of Birth | 1931 (some sources say 1933) |

| Place of Birth | Illinois, USA |

| Date of Death | August 2011 |

| Nationality | American |

| Education | Elmhurst High School; University of Illinois / Roosevelt University (Business Studies) |

| Military Service | U.S. Army during the Korean War |

| Early Career | Partner in entertainment complex, VP and COO at Greyhound subsidiaries |

| Major Roles | CEO & Chairman of Dial Corporation; CEO of Greyhound Food Management |

| Known For | Transforming Greyhound into Dial Corporation: Strategic corporate restructuring |

| Net Worth at Peak | Estimated $50 million – $100 million |

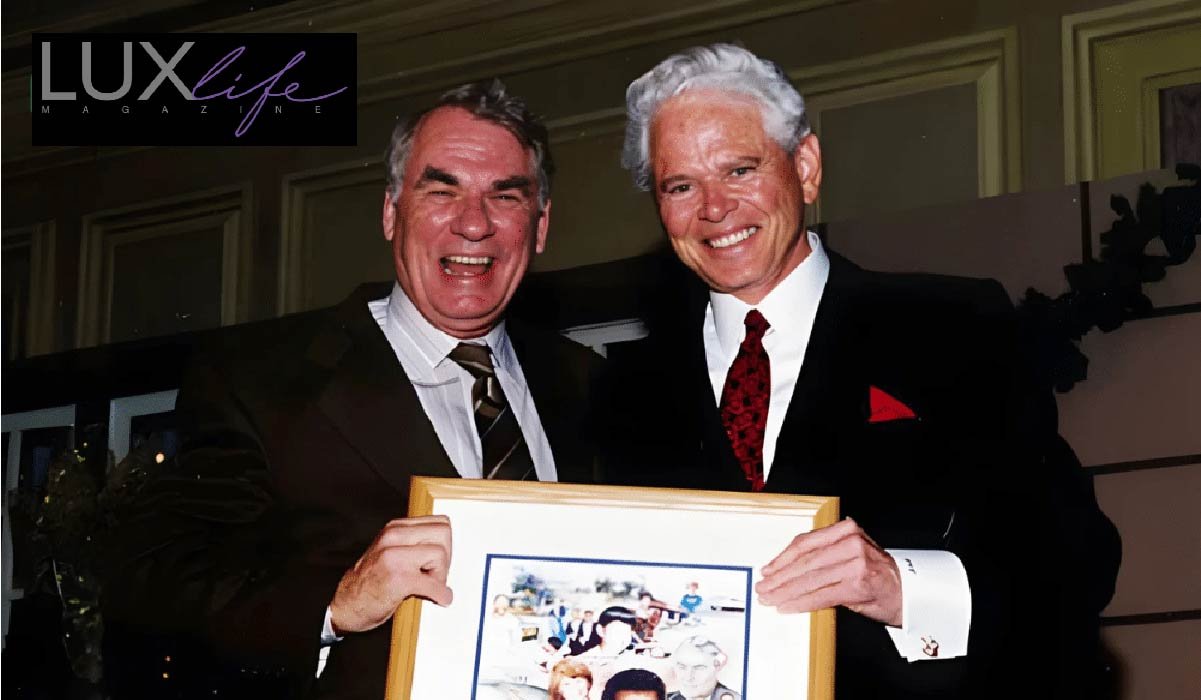

| Awards | Ellis Island Medal of Honor |

| Philanthropy | Support for education and civic development |

| Legacy | John Teets Park in Phoenix, Arizona; Business leadership influence |

Early Life and Background: The Foundation of a Business Visionary

Born in Illinois during the Great Depression, John Teets grew up with strong values of resilience and hard work. His early experience working at his father’s gas station taught him the importance of excellent customer service and profit margin awareness, principles he carried throughout his career. After graduating from Elmhurst High School and serving in the Korean War, he studied business at the University of Illinois. By age 29, Teets co-owned a suburban Chicago entertainment complex, signaling his entrepreneurial spirit early on.

The Corporate Climb: From Food Services to Greyhound Leadership

Teets began at Greyhound Corporation in 1963, developing restaurants for the New York World’s Fair. His rapid rise was marked by becoming the youngest COO of a Greyhound subsidiary at 32. As Vice President of Greyhound’s food services, he cut costs, tripled margins, and grew sales by 60%. These achievements highlighted his financial acumen and leadership qualities that would prepare him for bigger challenges ahead.

The Strategic Pivot: Transforming Greyhound Corporation

Facing a struggling transportation business, Teets sold Greyhound’s bus operations for $350 million in 1987, focusing the company on consumer products. He acquired Purex Industries, merging it with Dial and Armor divisions to build a consumer goods powerhouse. The company was renamed Dial Corporation, and in 1996, it was split to focus separately on consumer products and services. Dial’s stock surged 400%, and the market cap increased from $1.2 billion to $4.8 billion under his leadership.

Building the $100 Million Net Worth: Income Streams and Investments

Teets’ wealth came from multiple streams: a CEO salary estimated between $15 million and $20 million over 15 years, stock options worth $30 million to $50 million, board roles after retirement earning $5 million to $10 million, and real estate investments valued at $10 million to $20 million. His preference for equity compensation aligned his wealth with company success. Notably, he sold Dial to Henkel AG in 1997 at an ideal time, and a Paradise Valley property he bought for $6 million appreciated to $42 million, reflecting his savvy investment approach.

Key Business Deals and Their Financial Impact

Among his most notable deals, Teets sold Armor Meatpacking to ConAgra for $2 billion in 1983 and Greyhound Lines for $350 million in 1987. His acquisitions of Dial, Purex, and Brillo expanded consumer brand portfolios, while Dial’s stock consistently outperformed the S&P 500 between 1991 and 1995. His restructuring efforts created shareholder value by streamlining operations and spinning off underperforming divisions.

Leadership Style and Corporate Philosophy

Rooted in early lessons of customer service and profit focus, Teets adopted a “pivot or perish” mentality, embracing change proactively. He empowered middle management with autonomy, reinvested savings into R&D, doubled innovation, and balanced cost-cutting with growth. His data-driven yet visionary leadership fostered accountability and continuous improvement across the company.

Legacy Beyond Net Worth

John Teets’ legacy extends beyond finances. Dial products became staples in most American homes. The John Teets Park in Phoenix honors his community contributions, and he received the Ellis Island Medal of Honor for business and philanthropy. His quiet support for education and civic causes reflects his belief in social responsibility, while his ongoing influence is felt in leadership education and corporate governance.

Conclusion: The $100 Million Lesson in Business Transformation

John Teets’ net worth is the result of visionary leadership, strategic risk-taking, and aligning personal success with company growth. His story teaches modern executives that adaptability, big-picture thinking, and ethical leadership can create extraordinary wealth and lasting impact. Teets remains a powerful example of how a leader’s vision can transform companies and industries for generations.

FAQs About John Teets Net Worth

1. How did John Teets accumulate his net worth?

John Teets built his wealth primarily through his leadership roles at Greyhound and Dial Corporation, earning a substantial salary combined with stock options and equity holdings. He strategically sold key business units like Greyhound’s bus division and acquired consumer brands, which increased the company’s value and his personal wealth. Additionally, Teets made successful real estate investments and earned income from board memberships after retirement.

2. What was John Teets’ estimated net worth at its peak?

At the peak of his career, John Teets net worth was estimated between $50 million and $100 million. This range reflects his combined earnings from executive compensation, stock options, board roles, and investment returns.

3. What were the biggest business moves that contributed to Teets’ net worth?

His most significant business moves included selling Greyhound’s bus operations for $350 million, acquiring Purex Industries to expand the consumer products division, and rebranding Greyhound to Dial Corporation. These strategic decisions transformed the company and drove its market capitalization from $1.2 billion to $4.8 billion.

4. How did John Teets’ early life influence his approach to business?

Growing up during the Great Depression and working at his father’s gas station taught Teets the importance of customer service and profit margin awareness. These early lessons shaped his focus on operational efficiency and customer satisfaction throughout his career, laying the groundwork for his corporate success.

5. How did John Teets approach executive compensation?

Teets favored equity-based compensation over immediate cash payments, aligning his personal financial success with the company’s long-term performance. This approach helped him accumulate substantial wealth as Dial’s stock value increased significantly under his leadership.

6. Did John Teets make investments outside of his corporate career?

Yes, Teets was a savvy investor, particularly in real estate. One notable example is a property he purchased in Paradise Valley for $6 million that appreciated sevenfold to $42 million over several decades, significantly adding to his net worth.

7. Are there any public honors or memorials recognizing John Teets?

John Teets was awarded the Ellis Island Medal of Honor for his business achievements and philanthropy. Additionally, John Teets Park in Phoenix, Arizona, was named to honor his community contributions and corporate leadership legacy.

8. How did John Teets’ leadership impact Dial Corporation’s performance?

Under Teets’ leadership, Dial’s stock soared 400% in five years, and the company’s market capitalization quadrupled. He modernized operations, expanded product lines, and strategically restructured the company, making Dial a household name and a market leader in consumer products.

Leave a Reply